Tax Climate

Frisco, Texas features a highly competitive tax system for businesses and residents alike. There is no state income tax in Texas, which results in substantial tax savings for the workforce. Local property taxes, or ad valorem taxes, are based on the 100% market value of the property. Property taxes are assessed based on factors such as property use, market conditions and property ownership. The process of the assessment of property tax is governed by Texas State Law.

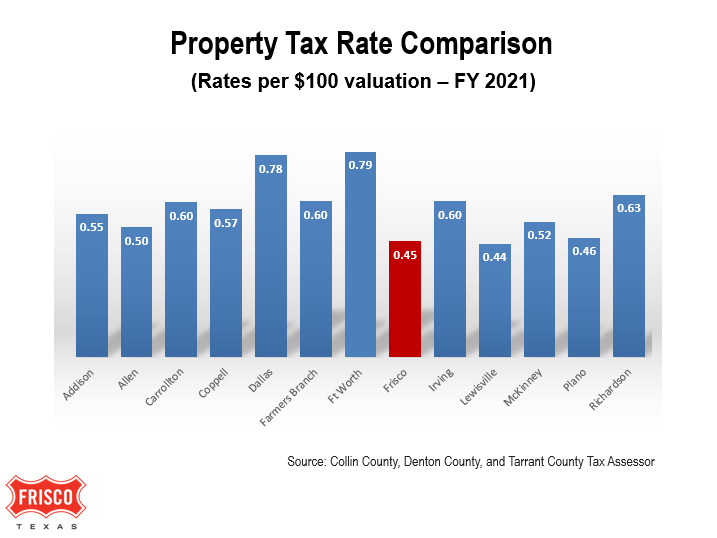

Property taxes fund local services such as Frisco’s top ranked public school system, fire and police protection, street maintenance, parks and other city services. Below are a few charts that compare Frisco’s property tax rates, as well as show the taxing entities. Information is provided for Collin and Denton Counties as Frisco is located within each of these two counties.

Combined property tax rate - City of Frisco/Frisco ISD - Collin County - $1.959851

Combined property tax rate - City of Frisco/Frisco ISD - Denton County - $2.010178

City of Frisco and State sales tax rate of 8.25%